Nakamoto Portfolio

A set of tools, research and open source code to explore the ground breaking effects that Bitcoin has on the financial world.Swan Research

Swan's mission is to drive Bitcoin adoption globally. Our new initiative, Swan Research, provides free & open source investment insights which have been historically reserved only for Wall Street institutions.

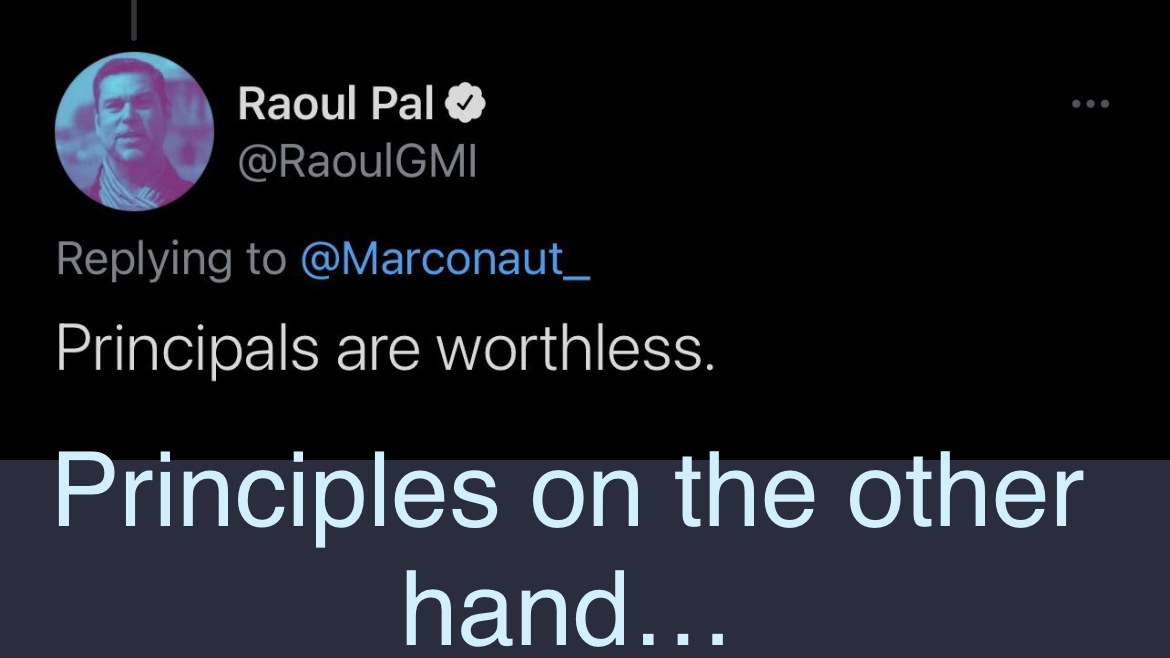

Principles

We are building Swan research with these core principles in mind:

Open Source Ethos

-=- no need to trust, just verify

Focus on Frameworks

-=-

assist in understanding concepts

Acknowledging Model Limitations

-=- all models are broken, some are useful

No Price Predictions

-=- impossible in a nascent technology

Bitcoiner-led

-=- no shitcoins

Bitcoin Network Stats

NgU Tech

connecting

24hr change in price

connecting

sats/usd

connecting

Mining Details

Current Network Hashrate

Progress to next difficulty adjustment connecting

Estimated difficulty adjustment connecting

Previous Adjustment connecting

Estimated Network Fees

Fastest

1 hour connecting

30 minutes connecting

Min Fee connecting

Countdown to Bitcoin Halving

connecting

Bitcoin's Schrödinger Model

The Schrödinger Coin Model is based on the concept of quantum superposition, where an object can simultaneously exist in multiple states until observed.

Bitcoin has been compared to various forms of property and other assets traditionally used for storing value. In the absence of sound money, rational investors allocate capital to real estate, stocks, and other alternatives as stores of value.

This model values Bitcoin based on the probability of capturing the monetary premium of some of these assets.

Portfolio Analytics

Simulate the effects of adding Bitcoin to your portfolio.

The portfolio analytics tool will simulate different allocations to a portfolio and measure return, risk, correlation and several other variables.

The model will also run optimization to find the optimal allocation to Bitcoin based on risk tolerance.

DCA or Lumpsum?

We often hear about two main strategies for bitcoin accumulation: Lump-sum investing and Dollar-Cost Averaging (DCA).

Lump-sum investing involves investing all available funds at once, while DCA involves allocating funds over regular intervals. We ran the numbers and found that lump-sum investing has historically outperformed DCA strategies. This is primarily due to Bitcoin's explosive upward price movements.

But DCA can lead to significant outperformance during bear markets. For instance, investors who bought at all-time highs but employed DCA afterward were able to break even significantly quicker. See the simulation results . While DCA has potential drawbacks, such as reduced returns in consistently rising markets, it remains a popular method for managing risk and promoting disciplined investing.

Real Estate: From bricks to bits

Unmask the truths and fallacies of the real estate market, an exploration that goes beneath the surface.

Is real estate truly the perfect shield against inflation? Perhaps it's time to reevaluate this age-old belief.

Even the best-performing areas do not offer significant real estate returns above inflation after considering real estate costs.

We've crunched the numbers, studied historical returns, and scrutinized the fundamentals to determine if real estate truly delivers on its promises. The hidden (and not so hidden) costs eat away most if not all of the returns.

Bitcoin Historical Return Analysis

We've taken a deep dive into Bitcoin's price behavior over the past decade.

Turns out, bitcoin's returns aren't as 'normal' as expected. Our analysis suggests that some distributions fit bitcoin's quirky behavior better than others. Add to this some interesting findings about how Bitcoin's past returns influence its future and we're onto some promising methods for predicting its price swings.

But remember, with bitcoin's notorious unpredictability, these forecasts are about getting a sense of potential moves, not crystal ball gazing.

Bitcoin & Retirement Accounts

Including bitcoin in a retirement account has several potential benefits.

An IRA with bitcoin can provide diversification, higher returns, and protection against debasement. Starting early, contributing annually and minimizing fees are critical.

You can run different scenarios below.

The Nakamoto Gauntlet

The Nakamoto Portfolio Gauntlet is a monthly show that explores the impact of integrating Bitcoin into established hedge funds, pension funds, and other investment portfolios.

Hosted by industry experts and featuring guest fund managers, the show runs selected funds through the gauntlet to analyze the financial and human effects of Bitcoin allocation. It provides real-time analysis, discussions, and hypothetical scenarios to help fund managers understand the potential benefits and risks of including Bitcoin in their portfolios. The goal is to create a safe platform for learning and experimentation, promoting the adoption of Bitcoin in the traditional finance world.

Bitcoin Priced as Default Insurance on a Basket of Sovereigns

Inspired by Greg Foss's work, this model utilizes the credit default swap (CDS) market to estimate the value of Bitcoin.

We employ the CDS market to estimate the probability of default for various countries. Subsequently, we use the probability of default to determine the value of Bitcoin.

Like all our research, this serves as a framework, not a model. We are not attempting to predict the future; instead, we aim to comprehend potential outcomes and the impact various variables could have on Bitcoin's valuation.

Satoshi Quotes

Connecting to Satoshi's Server...

Subject: ...

Additional Tools

Here you'll find tools to help in specific analysis and tasks. These include charts, research pieces and other supporting data.